Extension of tax and land rent payment deadline in 2023

The Vietnamese government has implemented tax policy measures to rescue the economy after the Corona pandemic. This includes a package of tax and land rental extension deadlines. The Decree takes effect from April 14, 2023 and is valid until December 31, 2023.

As part of many measures to boost the economy, the government issued Decree No. 12/2023/ND-CP on April 14, 2023. Experts from ECOVIS AFA Vietnam explain how companies The company can take advantage of extended tax and land lease payment deadlines and thus still have liquidity for necessary investments and growth.

Which companies are subject to tax payment according to regulations?

- Taxpayers are businesses, organizations, business households, and individual businesses that generate income in 2022 or 2023 in the economic sectors prescribed by the Decree (see box at the end of the article), including:

- Enterprise branches and/or affiliated units separately declare VAT/CIT directly to the tax authority directly managing them and operating production and business activities in regulated industries.

- Persons carrying out various production and business activities including specified activities

- Small and micro enterprises

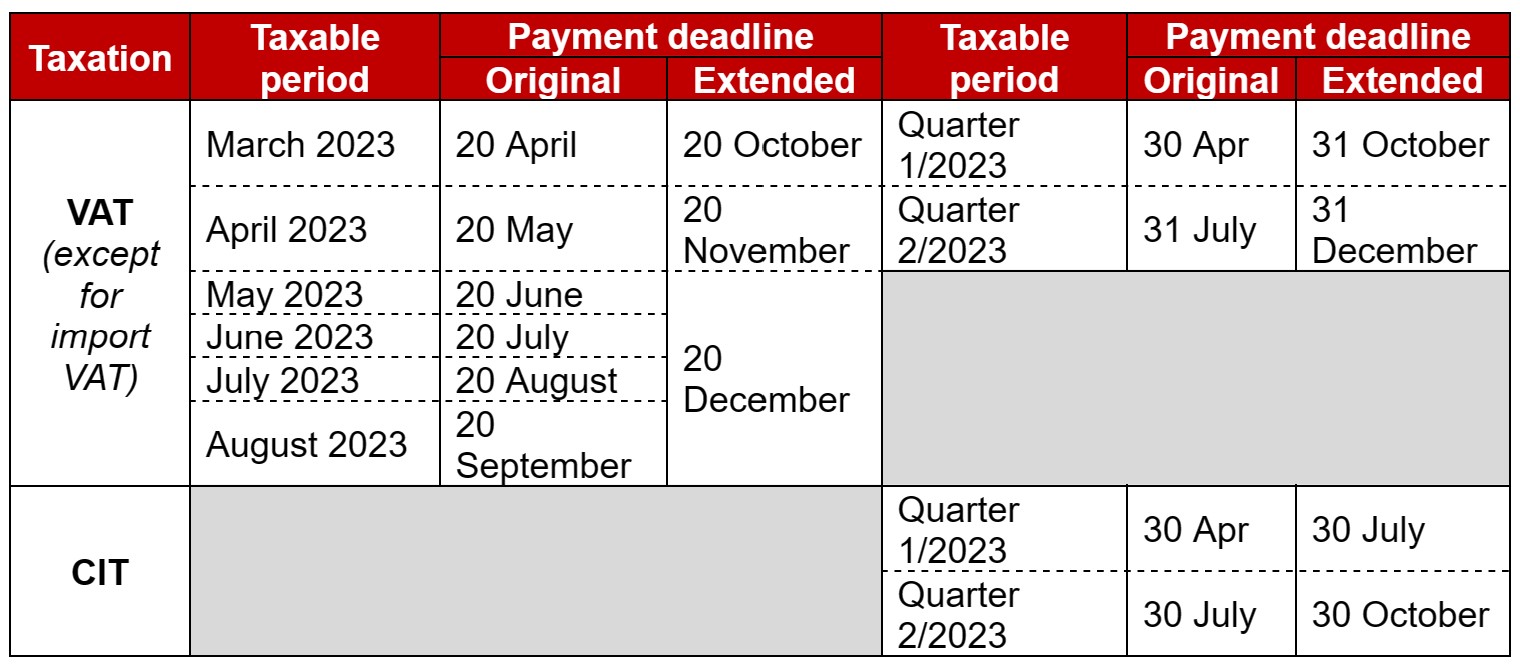

Overview of tax payment extension deadlines

Source: Ecovis

The payment of VAT and personal income tax of business households and individual businesses arising in 2023 will be extended until December 30, 2023.

Extension of deadline for paying 50% of land rent in 2023: Extended by 6 months from May 31, 2023 to November 30, 2023.

Administrative process

- Deadline for submission: no later than September 30, 2023 (can be submitted at the same time as prescribed by law for monthly/quarterly tax declaration)

- Place of submission: tax authority

- Return of results: the tax authority issues a written notice of disapproval if it determines that the taxpayer is not eligible for the extension of regulations.

- Exception: taxpayers must immediately pay the tax payable with the supplementary declaration if the supplementary declaration is submitted after the expiry of the corresponding extension period.

How industries must generate revenue

- Production activities (determined according to Decision No. 27/2018/QD-TTg):

- Agriculture, Forestry and fishery

- Food processing and production

- Textiles: apparel production; production of leather and related products

- Wood processing and production of products from wood and bamboo (except beds, cabinets, chairs, tables, chairs)

- Production of dry grass, straw, and plaiting materials

- Production of paper and paper products

- Manufacture of rubber and plastic products

- Manufacturing products from other non-metallic alloys, metal manufacturing, mechanical engineering, metal processing and cladding

- Manufacture of electronic equipment, computers and optical products

- Manufacture of cars and other motor vehicles

- Production of beds, cabinets, chairs, tables, chairs

- Construction

- Publishing, filming, television programming, recording, music production

- Exploiting crude oil and natural gas (no extension of CIT payment for crude oil, condensate and natural gas)

- Beverage production

- Printing, copying

- Coke, refined petroleum processing, chemical manufacturing, fabricated metal products (except machinery and equipment)

- Manufacture of motorbikes and motorbikes

- Repair, maintenance, installation of machinery

- Drainage and wastewater treatment

- Business activities (determined according to Decision No. 27/2018/QD-TTg):

- transportation and storage

- Accommodation, food and drinks

- Education and training

- Medical and social support

- Real estate business

- Labor and employment services

- Activities of travel agents, tour operators and support services or related to advertising and tour organization

- Creative, artistic and entertainment activities

- Activities of libraries, archives, museums and other cultural activities

- Sports and entertainment activities

- Film screening, radio and television broadcasting

- Computer coding, consulting services, and other computer-related activities

- Communication activities

- Mining support services

- Other: Manufacturers of supporting industries and key mechanical products.